These 3 insurance products are all important for small business owners, but they can sound similar to many people. In this article we will explain the difference between:

• Income protection insurance

• Business expense insurance, and

• Business insurance

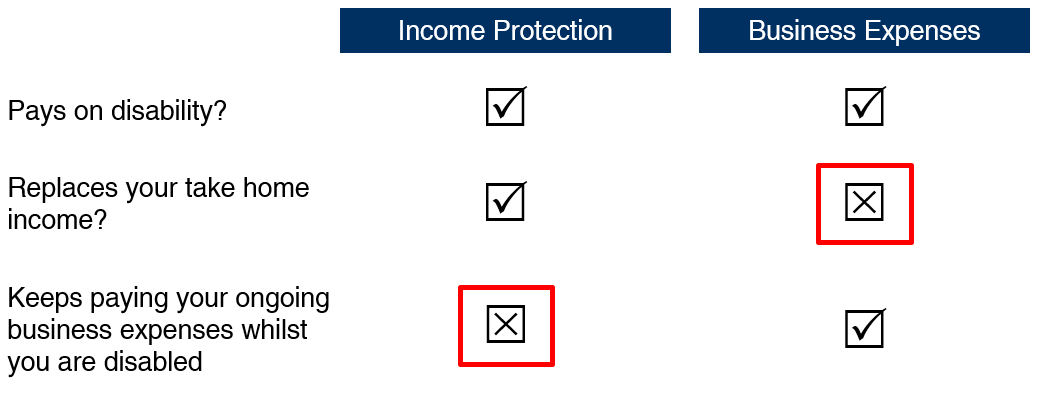

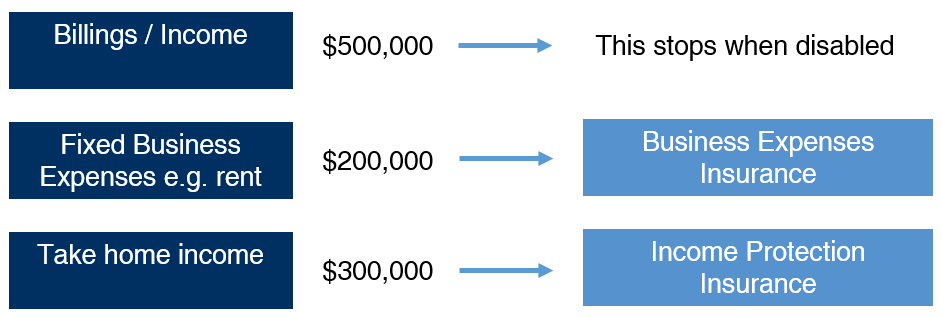

Income protection insurance will replace most of your “take home” income if you are ill or injured and unable to work for some time.

Business expenses insurance, is in the same family of insurance products as Income Protection because it also responds to illness or injury. However, instead of protecting your “take home income”, it will pay for fixed ongoing business expenses should you be unable to work because of illness or injury. If that unfortunately were to happen, then it is likely that your business revenue will reduce, but your fixed expenses (such as rent) will not. This product ensures that these expenses can be paid and protects you from needing to use your Income Protection payments for this.

The differences can be shown as follows:

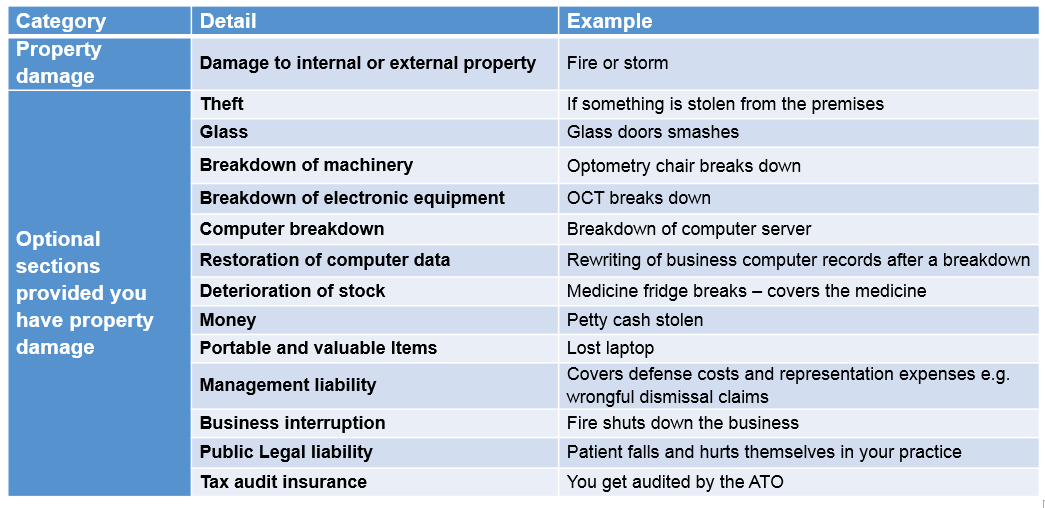

Business insurance, on the other hand, does not respond to your illness or injury. Instead it responds to perils such as fire or flooding and other risks such as theft and risk such as a customer being injured on your premises.

If you need a quote for any of the above insurances, or not sure what insurances you need, contact an Experien adviser on 1300 796 577