Medical indemnity insurance premium cost by specialty and trends over time

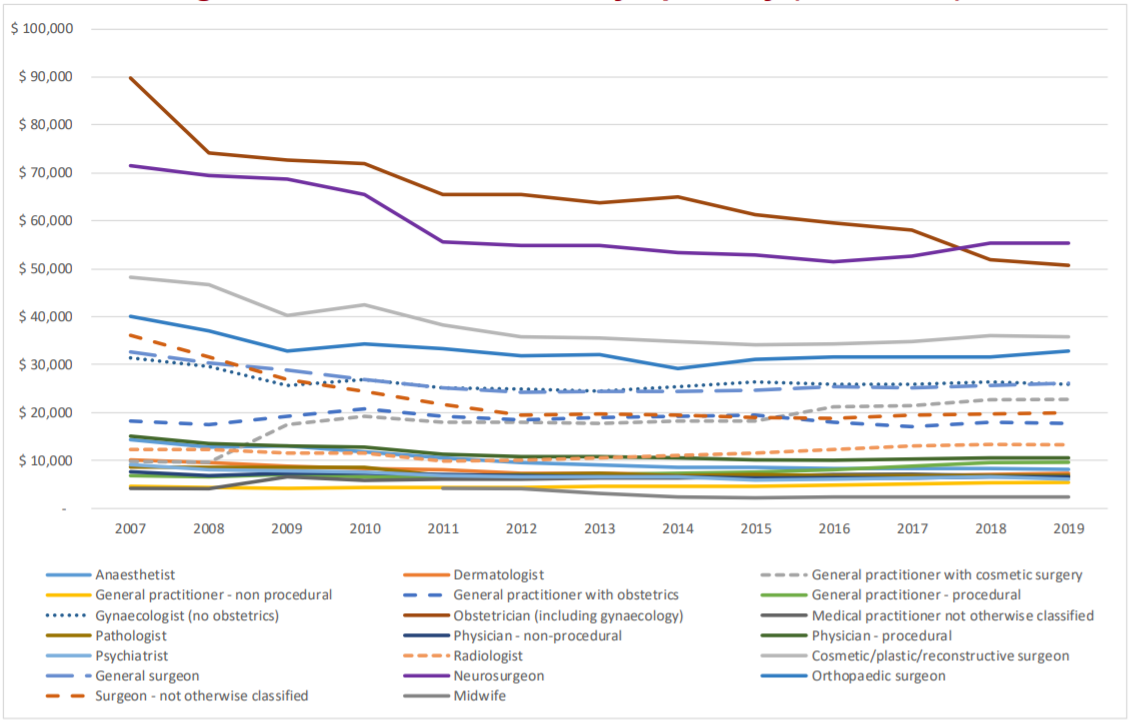

The graph below, from an Australian Government Actuary report on Medical Indemnity Insurance Premiums, released in 2020, shows the the median premiums in nominal values since 2007, before Premium Support Scheme subsidies. They include membership fees.

The median premium in nominal terms has remained relatively stable or decreased from 2007 to 2019 for almost all specialities.

Only five specialties including certain small subgroups of general practitioners have seen an increase in the median nominal premium, i.e. before adjusting for wage increases, over this period.

In recent years, premiums have generally been stable, and in some specialties have increased slightly.

Apart from the expected effects of inflation, this is consistent with broader industry trends including lower interest rates, a higher High Cost Claims Scheme threshold and the claims experience of some specialty groups

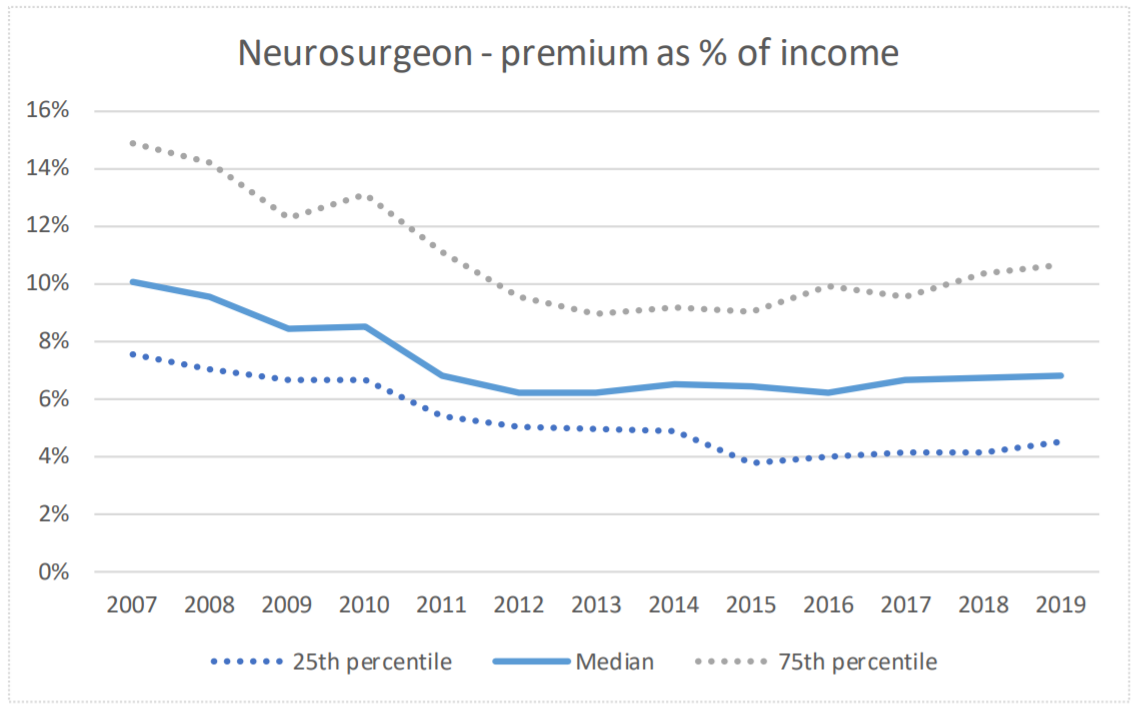

When nominal premiums are adjusted for private sector Average Weekly Earnings (AWE) there has been a decrease in real premium rates over this period. The greatest decline appears to be in the most expensive premium brackets

The membership fees collected by the industry in nominal terms since 2007 have grown from $15m to $51m over this period, and as a proportion of Gross Written Premium (GWP) it has increased twofold. The amount of membership fees charged varies widely between insurers.

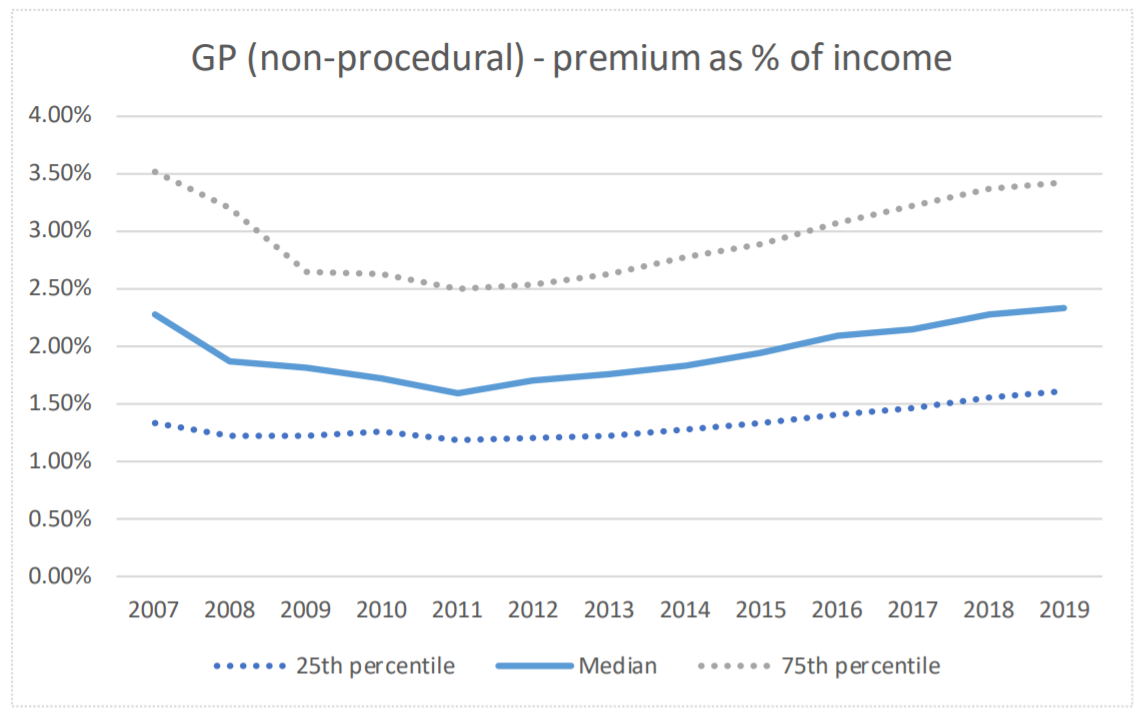

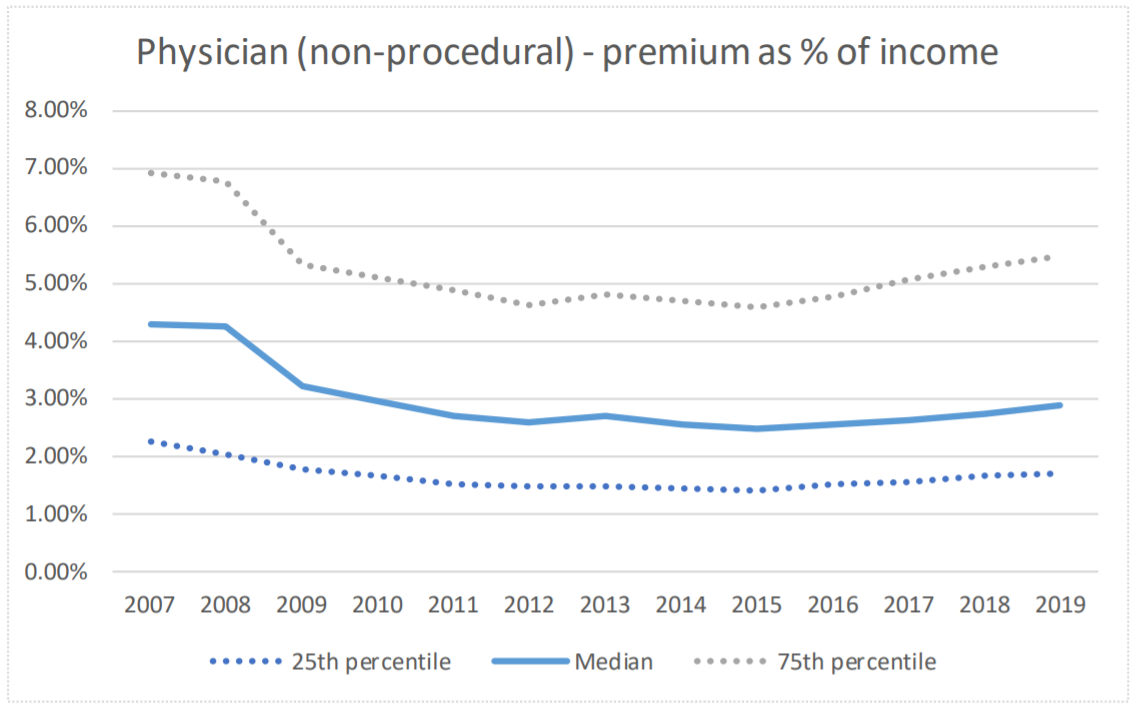

Premiums (including membership fees) before Premium Support Scheme subsidies, as a proportion of income, have also declined marginally over time. The median premium was approximately 2.5% of private practice income in 2019. The equivalent percentage in 2007 was 3.1%. Further, more policies now have a premium which is less than 10% of private practice income. Around 94% of all policies paid less than 10% in 2019 compared to 89% in 2007.

Median Premium by Specialty ($ Nominal)

Premium for Non-Procedural GPs as a Percentage of Private Practice Income

Premium for Non-Procedural Physicians as a Percentage of Private Practice Income

Neurosurgeon Premium as a Percentage of Private Practice Income

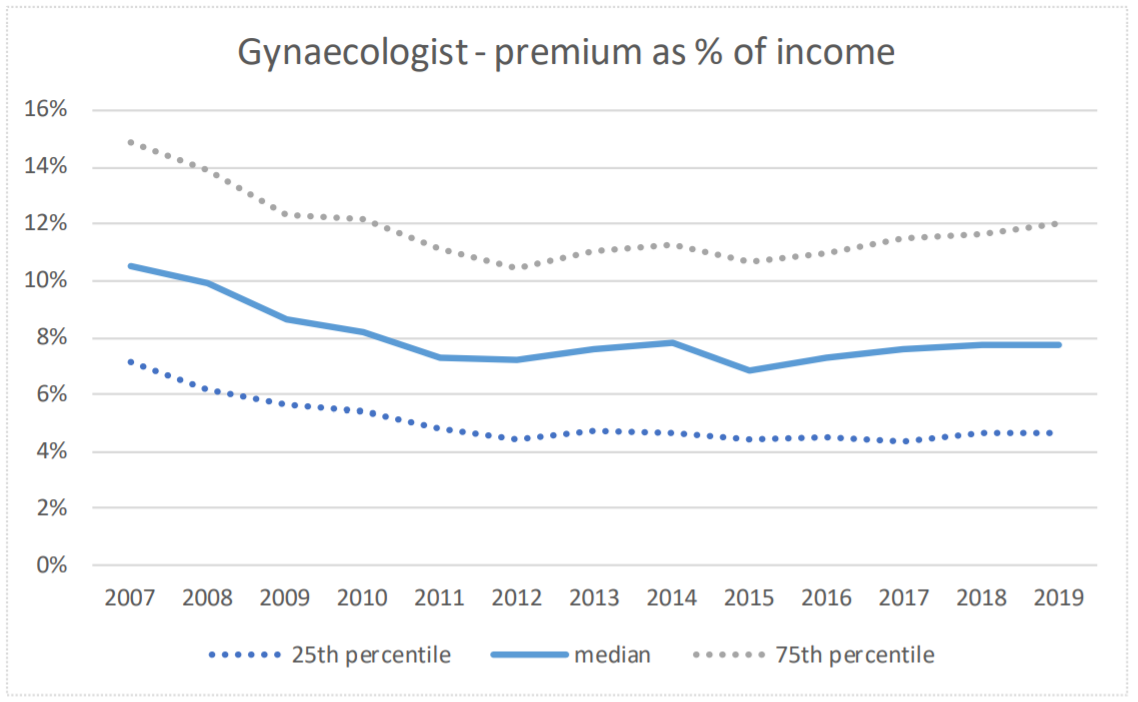

Gynaecologist Premium as a Percentage of Private Practice Income

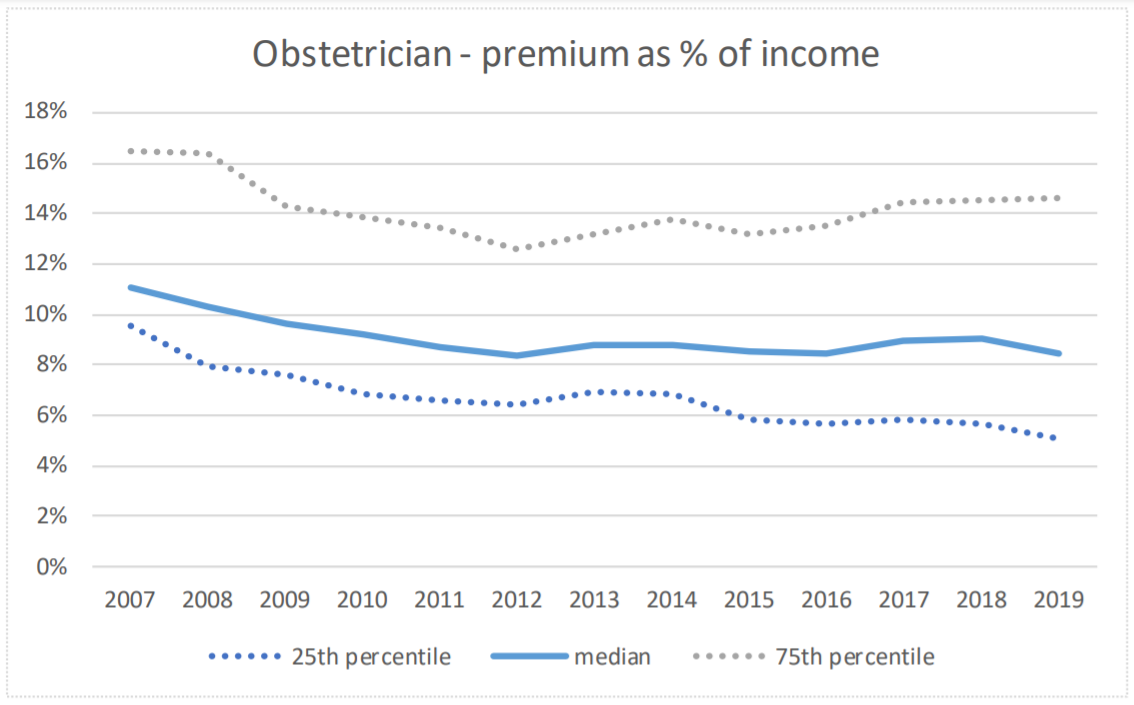

Obstetrician Premium as a Percentage of Private Practice Income

Source : Evaluation of the Stability & Affordability of Medical Indemnity Insurance. Australian Government Actuary. Released 16 November 2020

Experien General Insurance Services (Experien) is a national insurance brokerage firm. We help many doctors in the private sector with their medical indemnity insurance, and we give Doctors the valuable alternative to dealing directly (on their own) with insurers. We research the market to help find better coverage, pricing or other factors. If you engage us for a review, then we will not charge you if don’t decide to use us any further. A review is complimentary and without any obligations.

General advice on this website has been prepared without taking into account your objectives, financial situation or needs. Before acting on the advice, consider its appropriateness. Consider our disclosure documents, which include our FSG and each insurer’s Product Disclosure Statements (PDS) for insurance products. Please click here for our Financial Services Guide, which includes important regulatory disclosures regarding our license, remuneration and complaints handling.