When we prepare your financial plan, and an investment strategy is in scope, then we will consider a wide range of investment options. We will make recommendations and discuss these with you before any strategy is implemented.

An investment strategy may include recommending an investment platform, such as a Wrap Platform. It will also consider what assets should be used on any investment platform, such as ETFs and managed funds.

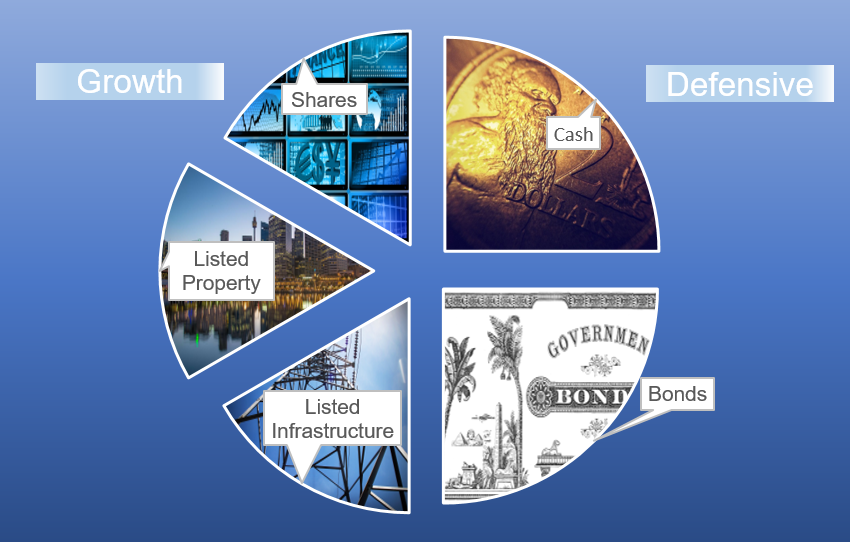

One important part of our planning process is to understand and agree on what is known as your investment “Risk profile“. We will then want to suggest an allocation in your investments between broad asset classes (like shares, property, cash and fixed interest investments) that matches your profile. Getting your asset allocation right is an important component of any plan. Investments can be classified as Defensive or Growth investments and these will be discussed with you.

Defensive investments are lower risk investments. They aim to provide income and protect the capital invested. Defensive investments include cash and fixed interest investments. They’re typically used to meet short-term financial goals and to diversify a portfolio.

Growth investments are higher risk and offer a higher potential return compared to defensive investments. They aim to give capital growth and some provide income (for example, dividends for shares or rent for property). But, the price of growth investments can be volatile over short periods of time. Growth investments are typically used to:

- Earn a higher rate of return (but this comes with higher risk).

- Meet longer term financial goals, five years or more.

- Growth investments include shares, property and alternative investments.

When we discuss investment options with you, we are known to be prudent, and therefore we do not recommend “exotic” or “high risk” investments such as :

– Cryptocurrency

– Forestry investment schemes

– Derivatives or margin lending

– Higher risk other alternative asset classes such as pure alpha strategies or infrastructure projects

Your recommended investment strategy will be presented to you in a Statement Of Advice document that will be discussed in detail with you.

ABOUT | ADVICE PROCESS |INVESTMENT APPROACH | IMPLEMENTATION & REVIEW | WHY ? | FEES

Past performance is not a guarantee of future performance.