Why may a Medical or Dental practice need Practice Indemnity Insurance?

Your medical or dental practice “business legal entity” may need its own medical or dental entity malpractice insurance cover in addition to your “Individual” medical or dental malpractice insurance.

Medical and dental practices have separate exposures that may not be covered by your individual practitioner insurance. Without the correct indemnity insurance in place for your practice, you may have a gap in cover. What if a malpractice claim is brought against your business legal entity ? Will you have insurance cover that will respond ?

You should consider practice indemnity insurance if:

- your staff are involved in the care of your patients or work on patient files

- a patient sees multiple practitioners

- you have contractor or locum practitioners within your practice that may not be able to be located when a claim is made against the practice

- there are divided responsibilities and obligations for patient care, and

- several other situations

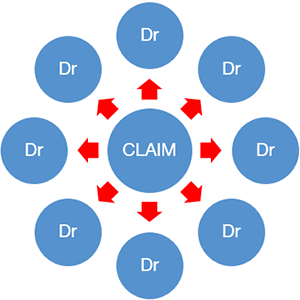

Protecting your practice and your practitioners

|

Exposed

|

Protected

|

| Without a practice policy

A claim made against the practice would be shared across each practitioner’s individual policy or not be covered leaving you and your colleagues personally exposed. |

With a practice policy

Your personal claims record is protected from actions of your partners, employees, contractors or locums – ensuring your practitioner indemnity insurance is protected. |

What can be covered?

- civil liability cover for acts, errors and omissions of employees, and for the indirect responsibility of the practice for acts, errors or omissions of medical practitioners and other healthcare professionals.

- cover for your business so staff members’ actions do not impact upon your individual practitioner indemnity insurance policy.

- cover for principals, partners, directors, officers, employees, volunteers and students of the practice in their capacity as employees of the practice, and cover for the spouses and estates of those people in so far as they are brought into the claim.

- employee disputes cover; for employee contract disputes, including complaints under anti-discrimination or equal opportunity legislation for non-medical practitioners.

- cover for the fees and costs of a public relations consultant to assist in creating a response where necessary.

- statutory liability cover for defence costs in relation to breach of occupational health and safety law or environmental law.

- optional public liability insurance; covers claims for personal injury or damage to someone else’s property.

Do Practice Professional indemnity insurance policies work on a “claims made” basis ?

The Product Disclosure Statement, or Policy Wording, issued by the insurer together with your own Policy Schedule will note the terms that will apply to your cover. Generally, most professional indemnity insurance policies for Practice entities work on what is commonly referred to as a “claims made” or “claims notified” basis. This means that, subject to the other terms and conditions, you will be covered for claims first made against you and notified to the insurer during (and not after) the period of insurance. The policies do not generally cover matters you were aware of prior to the commencement of the period of insurance with the insurer. If you notify the Insurer of a matter for which you seek indemnity – after your Policy has expired or is cancelled – you may not be indemnified by the Insurer for that matter.

Two features that are commonly found with “claims made” policies are “Retroactive Cover” and “Run off cover” which are explained below :

What is run off cover ?

Run-off cover is a form of cover generally taken out by Practice Owners for if the business is closed permanently. Run-off cover is provided through an extended reporting period which allows you to notify claims against the Practice – or potential claims against the Practice – to the Insurer after the expiry of the period of insurance, in effect extending the period of insurance. You should notify the Insurer when you are closing the Practice so that you can purchase Run Off Cover. If offered, the insurer may do so via an endorsement to your current Policy – giving you an extended reporting period. Note that Run Off Cover will require an additional premium to be paid for it to be obtained.

What is Retroactive Cover ?

Subject to the Policy Wording and your own Policy Schedule, most insurers will offer what is referred to as “Retroactive Cover”. This means that, as long as a matter that you have cover for, was first made against you (or first came to your knowledge) during the period of insurance with that Insurer, Retroactive Cover broadly means that the insurer will cover you. The cover will be according to the terms of the Policy, even if the incident giving rise to the claim against you occurred before the commencement of the period of insurance with that Insurer, provided it occurred after the retroactive date. The matter must also be notified before the end of the current policy period. The Retroactive Date of your Practice Indemnity Policy determines how much of your prior practice is covered under your Policy.

General insurance services are provided by Experien General Insurance Services Pty Ltd ABN 77 151 269 279 AFS Licence No. 430190 (EGIS) trading as Experien Insurance Services.

Please click here for our Financial Services Guide, which includes important regulatory disclosures regarding our license, remuneration and complaints handling.

Please click here for our Financial Services Guide, which includes important regulatory disclosures regarding our license, remuneration and complaints handling.