Income Protection insurance is one of the most crucial and flexible insurance covers available. It is designed to replace your income if you are unable to work due to sickness or injury, covering you 24 hours a day, worldwide. Your health and happiness, your ability to earn an income is without doubt your most valuable asset and this must be protected. Providing for yourself or your family is your biggest responsibility.

Why is Income Protection Insurance important?

Your most valuable asset can be your ability to produce an income and this must be protected. Unfortunately, nobody knows when an accident or illness may strike. It is a little known fact that most insurance claims are for illnesses and these are not covered by Workers’ Compensation or other social security payments. People insure their cars, home and contents, yet maintaining all of these material possessions is reliant on our ongoing ability to earn an income. If you are sick or injured you may have some sick leave, or are able to draw on cash reserves for a short period of time. But consider the financial consequences of longer term incapacitation of 3 months or longer.

How long could you survive financially if your income stopped tomorrow?

Implementing an insurance policy which provides a monthly income during periods of longer term incapacity represents a logical, cost effective alternative. It is not uncommon for a couple to spend 15 years building up their assets, to then see it all disappear within 2 years because no income was received due to an injury or illness.

How does Income Protection insurance work?

Income Protection insurance is designed to substitute the insured person’s normal income (commonly up to 75% of their normal income for policies first issued prior to October 2021 and 60-70% of income for new policies thereafter) with monthly payments if you are unable to work as a result of illness or injury. The cover can be structured in a number of ways and the following options impact quite considerably on the premium cost:

- Waiting Period (or Excess Period) – The number of days you will need to wait from disablement before monthly replacement benefits become payable. Variables are 14, 30, 60 and 90 days or 6, 12 and 24 months, depending on your possible sick leave or maybe long service leave.

- Benefit Period – The maximum period of time a claim will be paid. Choices are normally 2 years, 5 years or through to age 65 or age 70.

- Claims Escalation (optional) – If a claim occurs, this will index the payments each year in line with the Consumer Price Index or a set percentage. Usually more applicable to Benefit Periods through to age 65.

Agreed Value or Indemnity Value Income Protection Insurance

Agreed Value policies were available to be purchased up until 31 March 2020 but are now generally closed to new applicants. Existing insured policyholders with such cover can apply for increases.

Indemnity Insurance policies are now the standard for new policies and there are sub-types of Indemnity Insurance policies in terms of feature generosity.

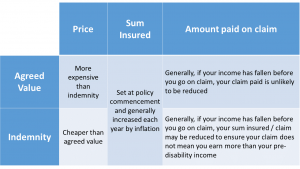

The monthly benefit in an Agreed Value policy is derived from your gross income at the time the cover commences. Therefore, under an Agreed Value policy any drop in income will not affect your Income Protection sum insured amount because it was ‘Agreed’ upon when you first took it out. The monthly benefit in an Indemnity policy is derived from your gross income at the time of claim (i.e. it is restricted to the sum insured or 75% [60-70% for policies issued after October 2021] of your income at the time of claim, whichever is the lesser). The benefit with this type of cover is that you sometimes do not have to supply financial records when taking out a policy. The down-side is that you will have to supply this when (if) you come to claim. These policies are generally cheaper than the Agreed Value policies and any drop in income will allow the insurer to reduce the benefits you will receive at claim time. A limited and broad comparison is shown below :

Note that each policy has specific features as described in its Product Disclosure Statement (PDS) and the above is a generalised indication only.

Is Income Protection Insurance Tax Deductible?

Importantly, the cost of Income Protection is largely tax deductible. The cost varies significantly based upon the waiting period, benefit period, amount of income insured and the insured occupation. Unlike some other forms of insurance, there are substantial differences between the quality of Income Protection policies currently available in the market. It is important that you obtain cover which is none restrictive and provide you with the surety and comfort that a legitimate claim will be honoured. The way in which the various policy features and benefits of an Income Protection policy are defined can play a critical role in determining whether a claim is payable – we subscribe to an independent research firm, which researches and compares the various contracts available to consumers. We utilise their evaluation to assist in selecting an appropriate policy for you. Please speak with an Experien Insurance Adviser for further information.

The information provided contains general information and examples and does not take into account your personal objectives, financial situation or needs. It is important, before deciding whether to act on any of the topics. that you consult a licensed or authorised financial adviser if you require financial advice that takes into account your personal circumstances. You should also review the Product Disclosure Statement (PDS) issued by each insurer before considering further. Note that the policy wording will differ from insurer to insure and loadings, exclusions and other limitations may apply by the insurer to each applicant on a case by case basis.