$2.9 trillion superannuation industry assets in the year ended June 30

The Australian Prudential Regulation Authority (APRA) has released the Annual Superannuation Bulletin for the year ended 30 June 2020.

Size

Over the five years from June 2015 to June 2020, total superannuation industry assets increased by 44.0 per cent from $2.0 trillion to $2.9 trillion. Over this period, APRA-regulated assets increased by 56.1 per cent from $1,2 trillion to $1,9 trillion and SMSF assets increased by 29.0 per cent from $569 billion to $733 billion.

Total superannuation industry assets were $2.9 trillion as at 30 June 2020. Of this total, $1.9 trillion was held by APRA-regulated superannuation entities and $0.7 trillion was held by self managed superannuation funds (SMSFs), which are regulated by the ATO. The remaining $210 billion comprised exempt public sector superannuation schemes ($147 billion) and the balance of life office statutory funds ($63 billion).

At 30 June 2020 :

- Small funds which include SMSFs, small APRA funds and single-member approved deposit funds accounted for 25.6 per cent of total assets.

- Retail funds held 20.7 per cent of total assets

- Industry funds held 26.0 per cent

- Public sector funds held 23.6 per cent, and

- Corporate funds held 2.0 per cent.

Investment returns

For APRA-regulated entities with more than four members including exempt public sector superannuation schemes :

- The annual rate of return for the 1 year ended June 2020 was -0.9 per cent.

- The 5 year average annualised rate of return to June 2020 was 5.3 per cent and

- The 10 year average annualised rate of return to June 2020 was 6.9 per cent.

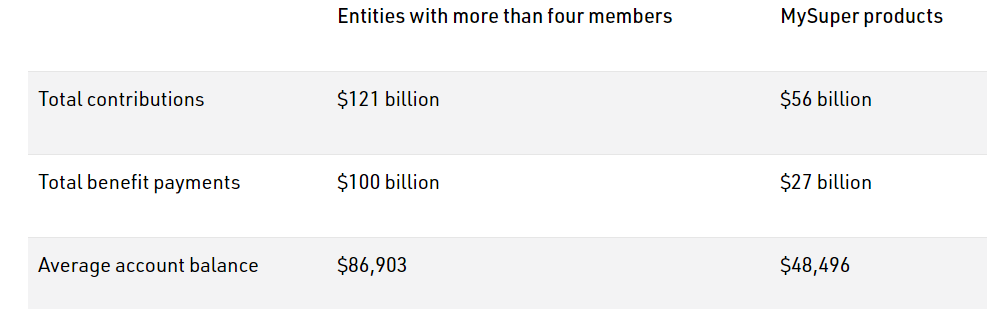

Key statistics for the superannuation industry as at 30 June 2020 :

Key statistics for entities with more than four members for the year ended 30 June 2020:

The average account balance was $77,479 for females and $95,257 for males.

The bulletin from APRA can be found here.

Experien Financial Services :

We would love to be your trusted advisor. Click HERE to get in touch to book an free introductory consultation. Contact us on Tel: 1300 417 020 or email us at

![]()