So, you’ve made the decision to take out life insurance to protect yourself and your family but for one reason or another, you are looking for alternatives to full cover.

There is another option. Accident-only cover can help you to take care of yourself and your loved ones if, due to an accident-related injury or death, you become unable to.

What is accident-only cover?

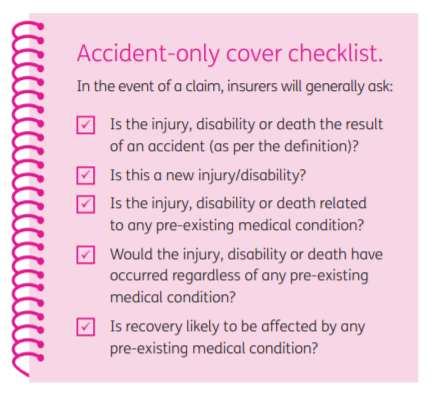

As the name suggests, this type of insurance pays a benefit in the event of an accident. It is different to comprehensive life insurance which also protects against death, disability and illness due to medical conditions such as cancer, heart disease and stroke. It is important to understand the distinction so you know exactly what you are and aren’t covered for.

There are three types of accident-only cover generally available.

- Accidental death will generally pay a lump sum benefit if you die as a result of an accident. You choose the amount of cover (benefit amount) you need.

- Accidental total and permanent disability (TPD) will pay a lump sum benefit if you are totally and permanently disabled as a result of an accident. There are multiple cover types based on different definitions such as ‘any occupation’ versus ‘own occupation’, and what constitutes home duties.

- Accidental income protection pays an ongoing monthly benefit amount for a defined period of time if you are totally or partially disabled as a result of an accident. You may need to be employed for a minimum number of hours per week to be eligible.1

Only a small number of insurers offer standalone accident only cover.

Why accident-only cover?

In the unfortunate event of a life-threatening or debilitating accident, the last thing on anybody’s mind should be money and returning to work. Yet, for too many families, it’s an overwhelming concern because the out-of-pocket medical expenses associated with a serious accident can be extremely high. You can help protect yourself and your family from financial hardship by taking out accident-only cover. Accident-only cover may be suitable if:

- You are unable to secure full cover due to a complex medical history

- You can’t afford full cover

- You want to top up existing insurances

- You want to minimise out-of-pocket expenses in the event of a workplace accident

In addition to paying benefits when you need it the most, accident-only cover also offers a range of built-in benefits that can make a difference such as grief support, accommodation and rehabilitation.

Accident-only covers can generally be held inside and outside of superannuation.

What is a typical definition of an “Accident” in a life insurance policy ?

One example is “An unintended or unexpected event which occurs and results in an injury which is not connected (i.e. independent) to any other cause. Suicide, injury due to natural causes, vascular accidents, allergic reactions or consequences related to any surgical procedure are not covered“.2

What can it be used for ?

The proceeds of accident cover, whether a lump sum or monthly payment, can provide long-term financial support. It can help cover funeral expenses, day-to-day living expenses, debt repayments or any special home modifications required. It can also be used for out-of-pocket rehabilitation expenses or medical costs which can add up. In the longer term it can be used to pay off outstanding debt, contribute towards education expenses or be invested to provide a future income.

Can I afford it ?

Accidental covers are usually available at a lower cost than full cover. For example, depending on individual circumstances, a 41-year old, non-smoker looking to purchase $900,000 (sum insured) of accidental death cover could expect to pay around $273 annually (female) or $539 annually (male).3

How can I apply ?

Experien Insurance Services can help you determine and obtain the right type and amount of cover for you. Unlike other types of life insurance, accident-only cover does not generally require you to disclose family or medical history, or undergo medical underwriting. As a result, the application process can be much simpler, although it still relies on complete and open disclosure. For example, you need to provide information about your occupation, pastimes, residency, travel history and, in some cases, income.

To find out the insurance options that may be best suited to you, contact us here.

- This is relevant for ClearView LifeSolutions but may differ for other providers.

- Please note this is the definition provided in the Clearview LifeSolutions PDS and may not be the same definition used by all insurers.

- The amount is based on ClearView LifeSolutions cover for a 41-year old, non-smoking male/female. Rates are current as of April 2019.

This article is reproduced from an article prepared by Clearview Wealth Management. It is intended to provide general information only and has been prepared without taking into account any particular person’s objectives, financial situation or needs (‘circumstances’). Before acting on such information, you should consider its appropriateness, taking into account your circumstances and obtain your own independent financial, legal or tax advice. You should read the relevant Product Disclosure Statement (PDS) before making any decision about a product.