Thankfully, to date, the medical impact of COVID-19 on the Australian population – whilst significant – has not been as bad as seen in other countries. Statistics from the Canadian life insurance industry shows a large amount of claims paid for death and disability from COVID-19 in 2020.

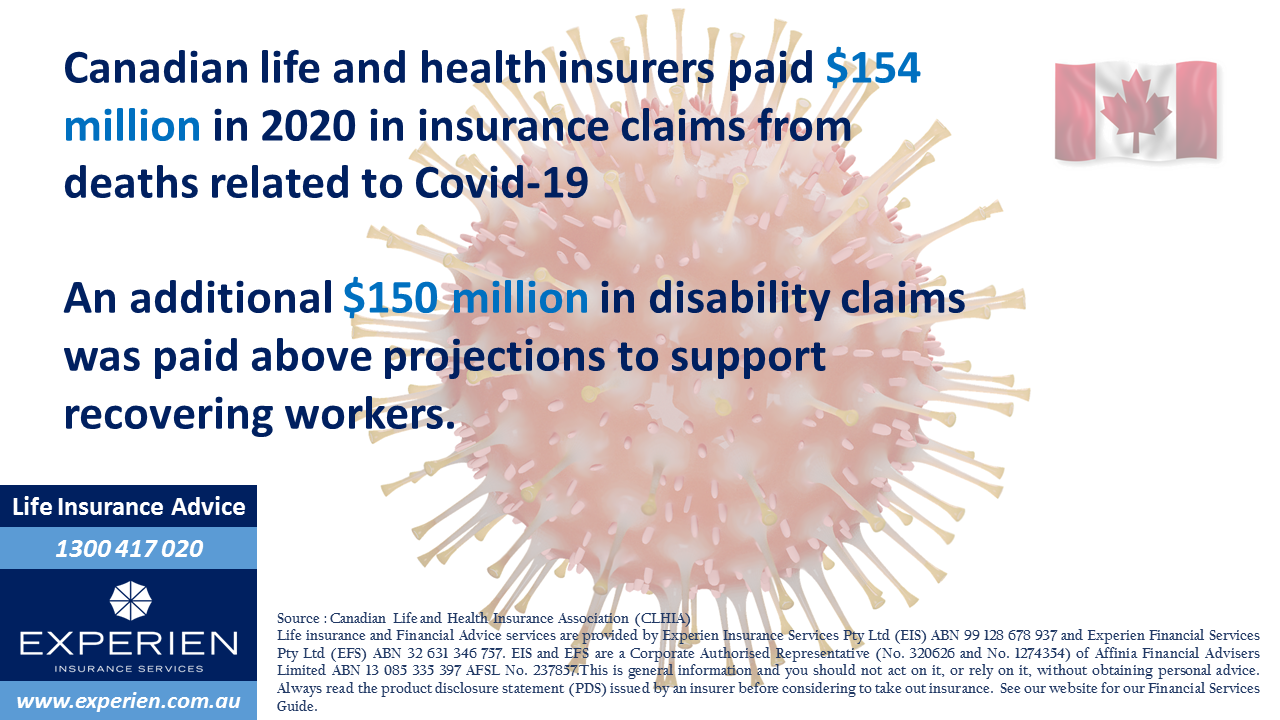

Canadian life and health insurers paid $154 million in 2020 in insurance claims from deaths related to Covid-19, and an additional $150 million in disability claims was paid above projections to support recovering workers. These are likely to be much higher than those seen in Australia. It shows yet again the important financial role that life insurers can play in supporting the economy and families when adverse health events arise.

At present, most Australian life and income protection insurance policies arranged by insurance advisers do not generally have standard COVID-19 exclusions. But speak to an Experien Insurance Services adviser to find out more about what coverage is available for you based on your own circumstances.

Source : https://www.clhia.ca/facts

Life insurance and Financial Advice services are provided by Experien Insurance Services Pty Ltd (EIS) ABN 99 128 678 937 and Experien Financial Services Pty Ltd (EFS) ABN 32 631 346 757. EIS and EFS are a Corporate Authorised Representative (No. 320626 and No. 1274354) of Affinia Financial Advisers Limited ABN 13 085 335 397 AFSL No. 237857. This is general information and you should not act on it, or rely on it, without obtaining personal advice. Always read the product disclosure statement (PDS) issued by an insurer before considering to take out insurance. See our website for our Financial Services Guide.