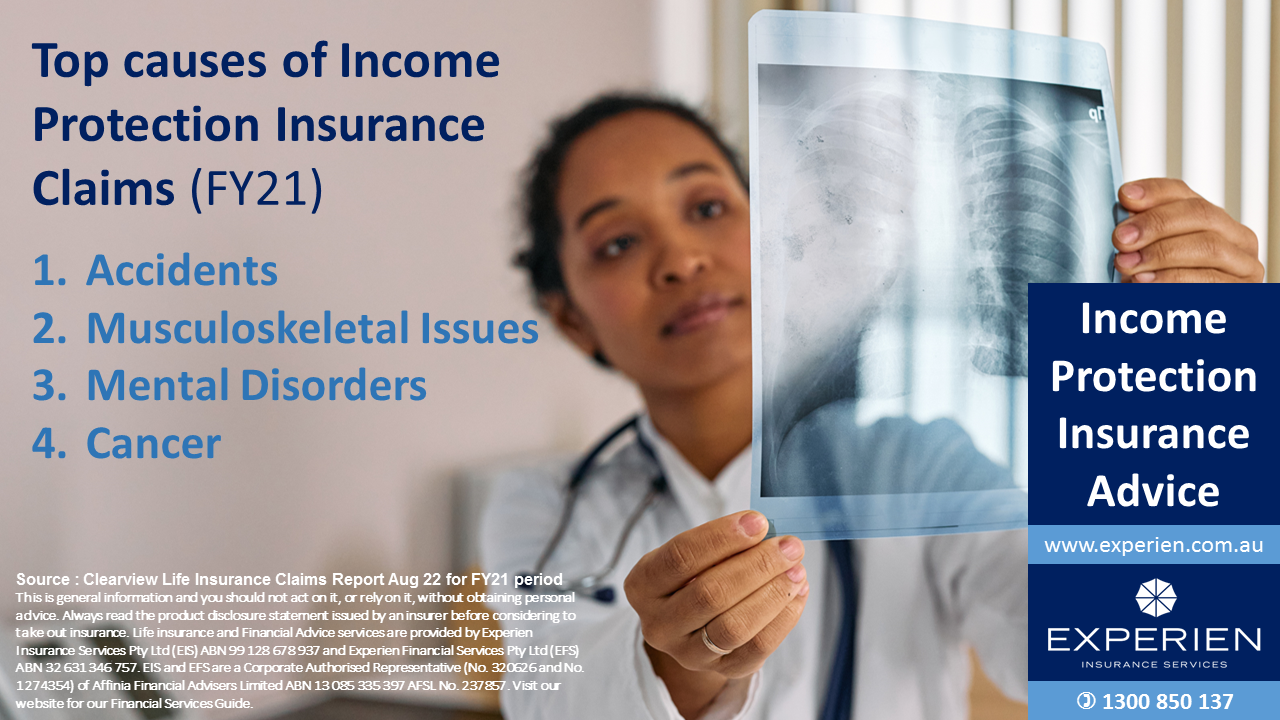

A report released in August 2022 from a life insurer shared their top causes of Income Protection Insurance Claims for the 2021 financial year. The top causes were :

1.Accidents

2.Musculoskeletal Issues

3.Mental Disorders

4.Cancer

Source : Clearview Life Insurance Claims Report Aug 22 for FY21 period

Trauma insurance (sometimes referred to as Critical Illness insurance) policies pay a lump sum if the Insured person is diagnosed with a medical condition and satisfies the definition of that specific event as specified in the insurance company’s Product Disclosure Statement. It is generally not dependent on whether you return to work or whether you work at all. It is paid as a lump sum. Trauma insurance can be taken as a stand alone policy or be attached to a life insurance policy.

Example of events that could ppotentially be covered with trauma insurance : Heart Attack, By-pass Surgery, Stroke, Cancer, Open Heart Surgery, MS, Benign Brain Tumour, Coronary Artery Bypass Grafting, Heart Value Surgery, Aorta Surgery, Cardiomyopathy, Cardiac Keyhole Surgery, Hemiplegia, Diplegia, Paraplegia, Quadriplegia, Major Head Trauma, Coma, Dementia & Alzheimer’s Disease, Parkinson’s, Motor Neurone Disease, Muscular Dystrophy, Major Organ Transplant, Chronic Kidney Disease, Chronic Lung Disease, Blindness, Deafness, Loss of speech, Severe Burns, Aplastic Anaemia, Occupational or Medical Acquired HIV… and more.

This is general information. If you would like to find out more about how life insurance works, and how much it will cost for you, feel free to contact us for a complimentary review. We can allow for your personal needs, obligations and financial circumstances to give you personal advice.

Life insurance and Financial Advice services are provided by Experien Insurance Services Pty Ltd (EIS) ABN 99 128 678 937 and Experien Financial Services Pty Ltd (EFS) ABN 32 631 346 757. EIS and EFS are a Corporate Authorised Representative (No. 320626 and No. 1274354) of Affinia Financial Advisers Limited ABN 13 085 335 397 AFSL No. 237857. See our website for our Financial Services Guide. Always read the Product Disclosure Statement issued by an Insurer before considering insurance