The Australian Prudential Regulation Authority (APRA) is an independent statutory authority that supervises institutions across banking, insurance and superannuation and promotes financial system stability in Australia. APRA released their “Year In Review” publication on 5th Feb 2021 which can be found here.

This report is interesting to read, in particular, the section on life insurance.

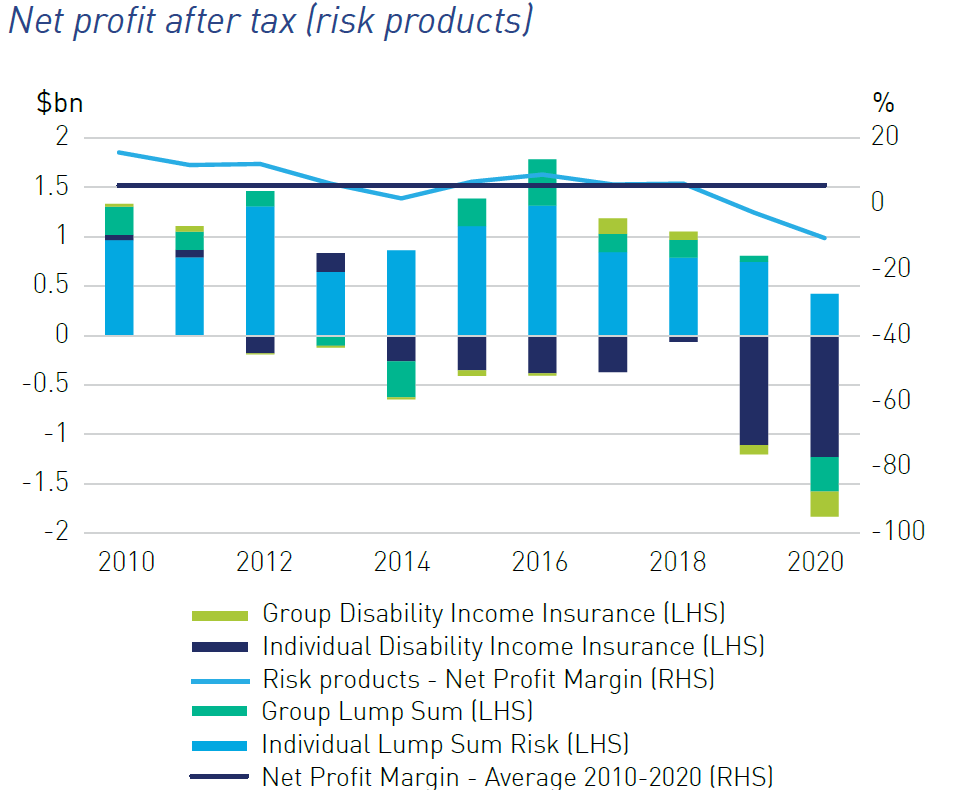

- Profitability of risk products has substantially declined in recent years.

- The net profit margin for 2019/20 was negative 10 per cent, considerably below the longer-term average of around 3 per cent.

- This result was driven largely by continued substantial losses in individual disability income insurance (IDII) and further declines in the profitability of individual lump sum and group business. See the graph below.

- Despite incremental premium rate increases in IDII in recent years, the combined effects of persistent adverse claims experience and the need to strengthen reserves contributed to the poor result.

- The profitability of group lump sum and group disability income insurance also declined during 2019/20. However, it should be noted that on an insurer-by-insurer level (as opposed to an industry aggregate level), profitability can be lumpy, with downward movements driven by the timing of insurers changing their assumptions about risk and the pricing of policies.

- APRA took material action in the life insurance market late in 2020, imposing capital penalties on providers of IDII to force them to address unsustainable business practices and persistent heavy losses.

- IDII is a valuable product that provides policyholders with replacement income when illness or injury prevents them from working.

- However, product design and pricing issues have seen the industry lose more than $4.8 billion in the last six years, and some policyholders have faced frequent and significant premium increases.

Please note that information in our news feeds are general information and you should not act on it, or rely on it, without obtaining personal advice. To find out the insurance options that may be best suited to you, contact us here. Always read the product disclosure statement issued by an insurer before considering to take out insurance.