Life (Risk) Insurance Premiums Market Share For The Year Ended September 2020

Total life (Risk) insurance premiums were down 0.4% to $16.1bn per annum over the year to Sept 2020

Plan For Life, Actuaries & Researchers is a research and analytics line of business under ISS Market Intelligence and they product media releases including quarterly updates on the market share of the various life insurers offering life risk insurance products. Extracts from their media release on 25th Jan 21, for the period to Sept 2020, are shown below.

It should be noted that this is commentary on market share only and market share is not a complete indicator of whether one insurer is more suitable for a person than another. There are many factors to consider in choosing an insurer for you and you should contact a financial adviser, such as those at Experien Insurance Services, to obtain personal advice based on your own needs.

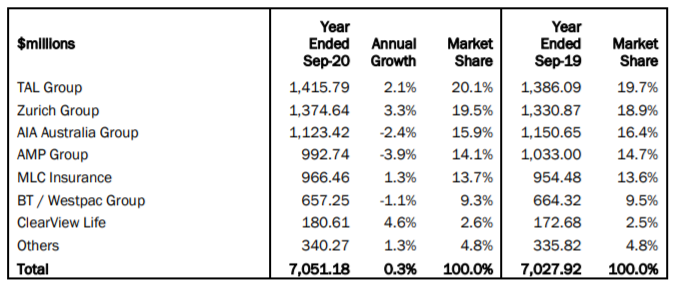

Individual Risk Lump Sum Premium Inflows (covering individual death, TPD and trauma policies)

The top 5 largest insurers make up 83.3% of the market.

Inflows into the segment grew 0.3% over the past year with mixed company-level results. Among the market leaders, ClearView (4.6%), Zurich (3.3%), TAL (2.1%) and MLC (1.3%) experienced positive percentage increases in their Inflows, while the remainder reported minimal or negative growth.

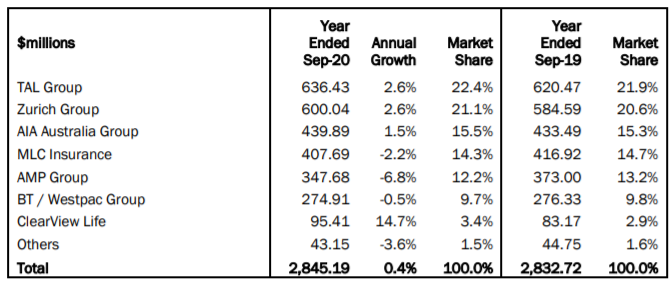

Individual Risk Income Premium Insurance Premium Inflows

The top 5 largest insurers make up 85.5% of the market.

Similar to the Lump Sum market, Risk Income Inflows experienced marginal growth, up 0.4% over the past year. Among the better performers in percentage growth terms were ClearView (14.7%), Zurich (2.6%) and TAL (2.6%).

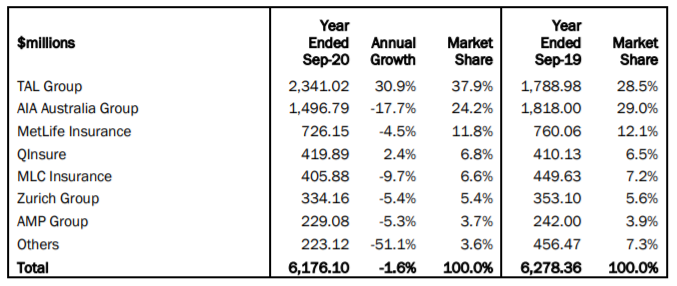

Group Risk Insurance Premium Inflows

The top 5 largest insurers make up 87.3% of the market.

This segment covers policies arranged by superannuation funds for groups of its membership based and companies for its employees. Overall Group Risk Premium Inflows experienced a 1.6% fall over the past year, with both ‘Protecting Your Super’ and ‘Putting Member’s Interests First’ legislation which came into effect during July 2019 and April 2020 respectively still impacting growth rates. Of the larger companies, TAL (30.9%) still managed to record significant growth. It should be noted that individual company growth can be significantly impacted by super fund insurance mandate movements, including REST Super moving from AIA to TAL late-2019 and BT/Asgard Super mandates moving from Westpac to AIA during the latest quarter.

Source : Plan For Life

Life insurance and Financial Advice services are provided by Experien Insurance Services Pty Ltd (EIS) ABN 99 128 678 937 and Experien Financial Services Pty Ltd (EFS) ABN 32 631 346 757. EIS and EFS are a Corporate Authorised Representative (No. 320626 and No. 1274354) of Affinia Financial Advisers Limited ABN 13 085 335 397 AFSL No. 237857. Please note that information in our news feeds are general information and you should not act on it, or rely on it, without obtaining personal advice. To find out the insurance options that may be best suited to you, contact us here. Always read the product disclosure statement issued by an insurer before considering to take out insurance.