Life insurance offers important protection for millions of Australians, making it critical to understand the benefits and latest news.

Life insurance comes in many different forms such as life cover, total and permanent disability cover, critical illness or trauma cover, and income protection cover. Each can play an important role protecting you and your loved ones’ lives.

Yet many people remain unsure of why they need life insurance or whether it will be there when they really need it. Throw in ongoing regulatory changes and many Australians may not have the cover they assume or may even be holding back from taking out a policy at all.

The life insurance industry paid out $10 billion in claims last year according to industry group, the Financial Services Council. Here are five reasons why it’s worth making sure you’re covered in the event of disaster.

Please note that information below is general information and you should not act on it, or rely on it, without obtaining personal advice. To find out the insurance options that may be best suited to you, contact us here. The information is current as at Oct 2019 and may become out of date over time.

1.People making life insurance claims are younger than you think

Australians enjoy some of the longest lifespans in the world. Men and women aged 65 in 2014-2016 can expect to live to 84.6 years of age and 87.3 years of age respectively, according to the Australian Bureau of Statistics.

However, the average claim age for life insurance is only 66 years for men and 63 years for women, according to an analysis of ClearView data. It shows the importance of insuring against the unexpected, whether a terminal illness or death due to accident or illness, so that you can maintain your standard of living, including paying for medical treatment, or look after loved ones if you’re not there.

2.Insurance claims involving advisers are more likely to be accepted

A comprehensive 2016 life insurance survey by the corporate regulator, Australian Securities and Investments Commission (ASIC), found insurance claims were declined in just 7 per cent of claims when a financial adviser was involved.

Life insurance claims through a superannuation fund (known as group insurance) were declined in 8 per cent of cases while direct life insurance (sold through the Internet or a call centre), were declined in 12 per cent of cases.

However, one insurer via direct sales declined 29 per cent of claims while one insurer via a super fund declined 23 per cent of claims, suggesting a skilled financial adviser can be invaluable to ensure protection is there when you or your family needs it most.

An adviser can ensure you have the right type of cover provided by a reputable insurer and then help you navigate the process if you need to make a claim.

3.Most life insurance claims are processed quickly

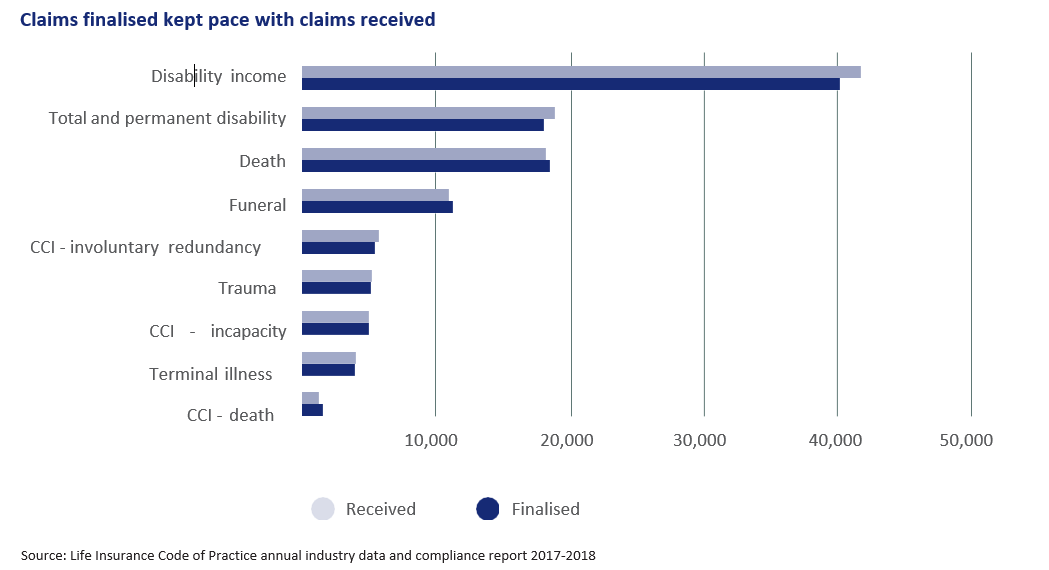

More than 130,000 insurance claims were processed in 2017- 18 by the major insurers that have subscribed to the new Life Insurance Code of Practice.

The industry reported that 89 per cent of income-related insurance claims were decided within two months while 92 per cent of non-income-related claims were decided within six months.

Having confidence that your insurance claim will be finalised in a timely manner is crucial for peace of mind.

4.New legislation may close your insurance if it’s attached to super

Many superannuation funds automatically include life insurance. Unfortunately, many people are unaware they have this insurance or are unlikely to ever use it – the result is their retirement savings are slowly sapped premiums.

The Government’s new Protecting Your Super package aims to stop this happening. From 1 July, 2019, super accounts with insurance that are inactive for at least 16 months will have their insurance cancelled.

Funds have been informing anyone affected so they have the choice to opt-in to continue their insurance. If you have any concerns, contact your financial adviser who can also ensure you have the most appropriate life insurance.

5.Life insurers want a regulatory overhaul so they can offer rehabilitation benefits

Employment provides people with the money they need to support their lifestyle. However, those who are incapacitated and unable to work lose more than an income: it can also dent their happiness and self- confidence.

Life insurers are lobbying for a change to legislation which would allow them to fund treatment for Australians at risk of long-term incapacity where they are not covered by private health insurance or stuck on public healthcare waiting lists.

Research commissioned by life insurance representative group, the Financial Services Council, suggests such reforms could provide benefits up to 10,118 people per year while 87 people could be prevented from becoming totally and permanently disabled.

Early intervention by life insurers could also cut return to work times from 18 to 13 weeks.